About Us

With the company Binary Options (Trading), means that a contract is being created which gives the Client the right to estimate the direction of change in price of an underlying asset, within a certain time frame determined by the Company. This trading instrument is distinct from trading in traditional way, since there is a fixed return that is determined at the outset of the trade, such as: there is usually no Stop-Loss order and other features.

Account Opening Client may apply for an account through the Company’s website and the Company will accept such account opening application (the Trading Account) under the following terms: (i) the Company has received confirmation that the Client has agreed to enter into this Agreement (such confirmation can be made by checking the AGREE button or link on the Company’s Internet website (the Website), followed by a completed application form (if applicable) and all other Client’s information required by the Company to be provided. The Client confirms that Client’s information is full, accurate and complete. If there is a change in the information provided by the Client, the Client must notify the Company immediately of any such change.

Usage of the Trading Platform is done through the Account, by a limited license provided by the Company to the Client. The license is personal, non-transferable and is for persons who are older than 18 years old (or older legal age, if the law applicable to the Client’s jurisdictions requires a higher legal age) and subject to this Agreement. The Client will not transfer, assign, or enable other to make any use of the license, and/or give the Clients access codes to the Trading Account to anyone. Any damage caused to the Client, the Company and any third party due to breach of this Agreement by Client, shall be under the Client’s sole responsibility.

Activation of the Trading Account The Account will be activated by the Company as soon as the Company has identified the funds credited by the Client to the Trading Account. The Company may activate the Trading Account and permit trading in the Trading Account subject to such limitations, and to the satisfaction of such further requirements as the Company may impose. Where a Trading Account is not activated or is frozen, no funds held by the Company in respect of that Trading Account may be transferred back or to any other person until the Company is satisfied that all Applicable Regulations have been complied with.

The Company may act, according to the Company’s sole discretion, as principal or as agent on the Client’s behalf in relation to any Transaction entered into pursuant to the Agreement. Therefore the Company may act as the counter party to the Clients Trading activity. The Client confirms that it acts as the sole principal and not as agent or trustee on behalf of someone else.

The Client hereby represents and warrants that his engagement with the Company in this Agreement and his use of the Company’s services are in full compliance with the law applicable to the Client.

THE TRANSACTIONS

The Trading Platform enables Binary Options trading in exchange rates of different currencies, commodities, and any other financial instruments made available by the Company. The Trading Platform displays indicative quotes of exchange rates of different financial instruments pairs, based on different financial information systems, as the most updated exchange rates in the international capital markets. For determining the quotes for different time periods, the platform is making mathematical calculations according to known and accepted capital markets formulas. It is acknowledged by both Parties that due to different calculation methods and other circumstances, different trading platforms and/or markets may display different price quotes.

The Client will receive a predetermined pay-out if his binary option transaction expires in-the-money, and he will lose a predetermined amount of his investment in the Transaction if the option expires out-of-the-money. The predetermined amounts are a derivative of the collateral invested in the transaction by the Client, and will be published in the Trading Platform. The degree to which the option is in-the-money or out-of-the-money does not matter as it does with a traditional options

The Client authorizes the Company to rely and act on any order, request, instruction or other communication given or made (or purporting to be given or made) by the Client or any person authorized on the Client’s behalf, without further inquiry on the part of the Company as to the authenticity, genuineness authority or identity of the person giving or purporting to give such order, request, instruction or other communication. The Client will be responsible for and will be bound by all obligations entered into or assumed by the Company on behalf of the Client in consequence of or in connection with such orders, requests, instructions or other communication.

The Company reserves the right, but not obliged to the following: to set, at its absolute discretion, limits and/or parameters to control the Client’s ability to place orders or to restrict the terms on which a Transaction may be made. Such limits and/or parameters may be amended, increased, decreased, removed or added to by the Company.

Arbitrage/cancellation of orders and transactions. The Company does not allow actions or non-actions based on arbitrage calculations or other methods that are based on exploitation of different systems or platforms malfunction, delay, error etc. The Company is entitled, by its own discretion, to cancel any transaction that has been executed due or in connection with an error, system malfunction, breach of the Agreement by Client etc. The Company’s records will serve as decisive evidence to the correct quotes in the world capital markets and the wrong quotes given to the Client; The Company is entitled to correct or cancel any trade based according to the correct quotes.

Cancel Feature Abuse

Company offers a special cancellation feature that allows traders to cancel a trade within a few seconds of execution. Abuse of the cancellation feature can be considered market arbitrage and can result in forfeiture of profits. Company reserves the right to cancel a position if the cancellation feature is abused. The acceptable cancellation percentage cannot exceed 20% of the total number of executed trades. Cancelling more than 20% of the total number of executed trades is considered abuse of this feature and resulting profits may be forfeited from such abuse.

MARGIN

The Client may transfer funds to the Company with different methods of payment as permitted by the Company from time to time and in any currency (acceptable by the Company), and such funds will be converted and managed in the Trading Platform in US Dollars and/or Euro and/or GBP and/or CAD and/or AUD, as determined by the Company, according to an exchange rate determined by the Company’s according to the available market rates.

When making a bank transfer, the Client must send the Company an authentic SWIFT confirmation, stating full bank account details and proof that the bank account is registered under its name. Non-delivery of the SWIFT confirmation or in case that the details do not conform to the Client’s details registered at the Company may result in the funds not being credited to the Client’s Trading Account.

Whenever the Client transfers funds to the Company, those funds belong to the Company and will be treated by it as its own for the purpose of securing or covering the Client’s present, future, actual, contingent or prospective obligations, subject only to any contractual obligation of the Company to pay or return money to the Client according to the terms of this Agreement. The Client will not have a proprietary claim over money transferred to the Company, and the Company can deal with it in its own right. In determining the amount of collateral and the amount of the Company’s obligations to pay or return money to the Client, the Company may apply such methodology (including judgments as to the future movement of markets and values), as the Company considers appropriate.

The Funds deposited with the Company by the Client, together with any Profit or other Benefits the Client may be entitled to according to a specific agreement with the Company, shall be used as security to any Transaction, including Trading Losses, Commission and any other fee or debt owed by the Client to the Company, which will be automatically deducted from the Client’s equity in the Trading Account. The Client’s Funds shall not accumulate any interest or any other benefits. Trading in binary options that relate to a reference security shall not grant the Client any right to dividends, voting, allocations or any other Benefits, but may be subject to adjustments according to financial or corporate events which may have an effect the reference security, such as distribution of dividends, splits etc.

Repayment of any funds by the Company to the Client will be in the same currency and to the same account/credit card from which the funds were originally transferred, unless the Company has decided, by its own discretion, to return the funds to a different account of the Client.

The Client declares that all funds that it transfers to the Company do not derive from any criminal or other illegal activity and without any violation of any applicable anti money laundering laws and regulations.

The Client will have no claim against the Company and will not hold the Company responsible for any delay and/or differences originating from a credit company’s, banks or other financial institutions rates calculation and/or commission and/or any other debit.

Withdrawals In case the Client gives an instruction to withdraw funds from the Trading Account, the Company shall pay the specified amount (less any transfer charges, if applicable) once a duly instruction has been accepted and at the moment of payment, the Client’s margin requirements have been met. Withdrawal procedure takes 24 hours once Client’s documentation submitted and approved. The Company may cancel the Client’s withdrawal order, if, according to the Company’s discretion.

The Company shall debit the Client’s Trading Account for all payment charges. If the Client has the obligation to pay any amount to the Company which exceeds the amount held in the Client’s Trading Account, the Client shall immediately pay such amount upon Company’s request.

The Company shall not provide physical delivery in relation to any Transaction. As mentioned above, Profit or loss is credited to or debited to or from the Trading Account (as applicable) once the Transaction is closed.

FEES & CHARGES

The Company does not charge brokerage fees or commissions for executing trades.

The Company charges a fee for transfers of funds standing to the credit of a Trading Account from the Company to the Client, currently equivalent to 35 units per transfer.

ACCOUNT STATEMENTS

Trading Account balances and statements are displayed within the trading platform made available to the Client by the Company. Common terms definitions can be found on the Company’s Website.

BONUSES

Company may offer the Client Bonus as Credit or tangible gifts, from time to time, at its sole discretion.

Bonuses and profits that are based, even partially, on use of bonus credit, shall be forfeited in case the Company suspects any act of fraud or breach of the Company’s Terms and Conditions by Client.

CLOSING AN ACCOUNT AND CANCELLATION OF THE AGREEMENT

Either party may terminate this Agreement by giving 10 (Ten) business days written notice by email to support@Assetpulse.com, of termination to the other party. Either party may terminate this Agreement immediately in any case of any breach of this Agreement or event of Default by the other Party. Upon terminating notice of this Agreement, Client shall be under the obligation to close all open positions, otherwise, the notice shall become void, or the Company shall have the right to close all open positions without assuming any responsibility. Such closer may result in outcome that would be less favorable for the Client.

Termination shall not affect any outstanding rights and obligations according to the applicable law and the provisions of this this Agreement.

Upon termination, all amounts payable by Either Party to the other Party will become immediately due.

LIMITATIONS OF LIABILITY AND INDEMNITIES

THE SERVICES OF THE COMPANY ARE PROVIDED AS IS AND AS AVAILABLE, AND COMPANY MAKES NO WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, WARRANTIES OF MERCHANT ABILITY AND FITNESS FOR PARTICULAR PURPOSE. THE COMPANY DOES NOT WARRANT THAT ANY AFFILIATED SOFTWARE, SERVICES OR COMMUNICATION THAT MAY BE OFFERED OR USED BY THE CLIENT SHALL ALWAYS BE FREE OF VIRUSES OR OTHER HARMFUL COMPONENTS. THE COMPANY WILL NOT BE LIABLE FOR ANY DAMAGES OF ANY KIND ARISING FROM TRADING OR THE USE OF THE COMPANY’S SERVICES, INCLUDING, BUT NOT LIMITED TO DIRECT, INDIRECT, INCIDENTAL, PUNITIVE, AND CONSEQUENTIAL DAMAGES.

Client acknowledges and agrees that the Trading Platform follows the relevant market, whether the Client is in front of his computer or not, and whether the Clients computer is switched on or not, and will exercises the order left by the Client if applicable.

The Company shall have the right to set-off any amount owed by the Company to the Client, against any debt or other obligation of the Client towards the Company. In any event of Default of Client (voluntary or involuntary insolvency procedures against the Client) all debts, future debts and other obligations of the Client towards the Company shall become immediately due.

GENERAL PROVISIONS

Amendments The Company has the right to amend the Agreement without obtaining any prior consent from the Client. If the Company makes any material change to the Agreement, it will give at least 10 (Ten) Business Days notice of such change to the Client. Such amendment will become effective on the date specified in the notice. Unless otherwise agreed, an amendment will not affect any outstanding order or Transaction or any legal rights or obligations which may already have arisen. Partial invalidity- If, at any time, any provision of this Agreement is or becomes illegal, invalid or unenforceable in any respect under the law of any jurisdiction, neither the legality, validity or enforce ability of the remaining provisions of this Agreement nor the legality, validity or enforce ability of such provision under the law of any other jurisdiction shall in any way be affected or impaired. Joint account- If the Trading Account is a joint account (on the name of more than one entity), then each of the entities in the Trading Account shall be authorized to represent the other entities towards the Company, with no requirement of any prior notice or approval from the other entities. Each of the entities in the Trading Account agrees that any notice or instruction given by the Company to any of the entities shall be considered as given to all the entities. In case of contradiction between instructions given to the Company by different entities, then the last instruction received by the Company will prevail. Notices Unless otherwise agreed, all notices, instructions and other communications to be given by the Company shall be given to the address or fax number provided by the Client, or via e-mail or other electronic means, details of which are provided by the Client to the Company. Any complaint shall be directed to the Company’s client services department, who will investigate the complaint and make every effort to resolve it. Such a complaint should be made to: support@Assetpulse.com Governing Law These Terms and any relationship between the Company and the Client shall be governed by law applicable in America and subject to the exclusive jurisdiction of American courts. The Company shall have the right, in order to collect funds owed to the Company by Client or to protect the Company’s rights such as good-name, intellectual property, privacy etc. to immediately bring legal proceedings against the Client, in the Client’s residency and according to the Client’s residency applicable law. No Right to Assign- No rights under this Agreement shall be assignable nor any duties assumed by another party except to/by an affiliate of The Company. Upon assignment to an Affiliate of the Company, the terms of this Agreement may be amended to fit any applicable regulation effective upon the assignee, and Client hereby consent in advance to such regulatory modifications to this Agreement. This Agreement shall be binding upon and inure to the benefit of the successors heirs of the Client. Dormant Trading- If the Client will not perform any trading activity or his trading activity will be in very low volume, for the time period defined by the Company, or if the Client does not hold minimum funds in his Trading Account, defined by the Company, the Company may, charge the Trading Account with Dormant Trading commission, at a rate to be determined by the Company from time to time, close any open trade and/or the Client access to the Trading Account and/or terminate this Agreement. Language, Notices and Complaints All communications between the Company and the Client will be in English or in any Language, suitable both to the Client and the Company. Force majeure The Company shall not bear responsibility to any harm or any form which shall be caused to the Client in the event that such harm is the result of a force majeure and any outside event which is not in the control of the Company which influences Trading. The Company shall not bear any responsibility for any delay in communications and/or failure in the internet, including, without limitation, computer crashes or any other technical failure, whether caused by the telephone companies and various telecommunication lines, the ISP computers, the Company’s computers or the Customer’s Computers.

We wish you successful trading!

Who We Are

The Assetpulse Group, is a leading global financial institution that delivers a broad range of financial services across investment banking, securities, investment management and consumer banking to a large and diversified client base that includes corporations, financial institutions, governments and individuals.

260+

investment professionals

20+ Countries

across five continents

2000+

investments globally

Leveraging Our Operating Expertise

Our experience as owners and operators enables us to effectively enhance cash flows, increase the value of our investments and produce solid long-term returns for our investors.

On-the-Ground Insights

Well-resourced operations in strategic locations around the world provide real-time market intelligence and bottom-up investment insights.

Hands-On Operations

Our integrated teams of seasoned operational professionals take an active role in maximizing the performance of our assets and businesses.

Comfort with Complexity

Across market cycles, we have built an expertise in executing large, creative transactions and managing ongoing growth projects to drive value.

Investing on a Value Basis

We seek to deliver attractive long-term returns and provide strong downside protection for our investors—including pension plans, endowments, foundations, sovereign wealth funds, financial institutions, insurance companies and the private wealth channel.

Contrarian View

We recognize that generating attractive returns often requires seeking out assets, businesses, markets and sectors that are out of favor or experiencing periods of distress.

Focus on Quality

We are disciplined in acquiring high-quality assets and businesses that we believe can provide strong downside protection across market cycles.

Patient Approach

We take a long-term view in deploying capital but are ready to act decisively when the right opportunities emerge.

Sustainability at Our Core

We are more than simply an investor—we are active participants in industries and economies around the world, and committed to the long-term health of these local markets.

OUR STRATEGIC PILLARS

A set of fundamental shifts in 2020 profoundly impacted the financial services sector. The demand for sustainable solutions and green finance rose to new highs. Interest rates are expected to remain lower for longer. And the Covid-19 outbreak increased our customers’ propensity and preference to engage digitally.

The current stage of our strategic plan responds to those shifts and aligns to our new purpose, values and ambition. It has four key pillars.

Focus on our strengths

To achieve our ambition, we are focusing on the areas where we have distinctive capabilities. This pillar of our strategy outlines where we are prioritising our efforts and investing for the future. We aim to:

- Be the global leader in cross-border banking flows aligned to major trade and capital corridors

- Lead the world in serving mid market corporates globally

- Become a market leader in Wealth management, with a particular focus on U.S.A, Europe and Asia

- Invest at scale domestically where HSBC’s opportunity is greatest

Digitise at scale

As people lead increasingly digital lives, this pillar of our strategy outlines how we are delivering faster, easier and more secure digital banking . We will:

- Create and deliver fast, easy, digital customer experiences

- Partner with technology innovators to enable new customer benefits

- Ensure our company is resilient and secure

- Execute with speed and automate at scale

Energise for growth

This pillar of our strategy outlines how we are energizing around growth. We want to:

Inspire a dynamic culture where the best want to work

Encourage an inclusive culture fostering diversity

Help colleagues develop future-ready skills

Be a simpler, more agile and effective organization

Transition to net zero

We want to do more than simply play our part in the transition to a more sustainable world. This pillar of our strategy outlines how we will help to lead it. We have committed to:

- Become a net-zero company

- Support our customers to transition to a low carbon future, especially in carbon challenged industries

- Accelerate new climate solutions

- Inspire our customers to invest to support positive change

Our Purpose and Values

Assetpulse mission is to advance sustainable economic growth and financial opportunity across the globe. Drawing upon over 15 years of experience working with the world’s leading businesses, entrepreneurs, and institutions, we mobilize our people and resources to advance the success of our clients, broaden individual prosperity and accelerate economic progress for all.

Chief Investment Officer

Financial Advisor

Financial Analyst

Our Values

Client Service

We lead with a service mindset, enabling us to anticipate and adapt to the needs of our clients and consumers by delivering thoughtful, innovative solutions.

Excellence

We aspire to nothing less than excellence, consistently striving for exceptional performance and achieving outstanding results for our clients, our shareholders, and our company.

Integrity

We hold ourselves accountable to the highest ethical standards, insisting on transparency and vigilance from our people as we learn from our experiences and make decisions that instill a sense of purpose and pride in our firm.

Partnership

We prioritize collaboration and value diversity, creating a culture that fosters inclusiveness, teamwork and an entrepreneurial mindset in the pursuit of professional and personal excellence.

Create a brighter Future together

Our new purpose defines who we are, who our stakeholders are, and the impact we want to have in the world. It’s an evolution. It builds on our legacy and better reflects how we serve the needs of our customers, employees, partners and society

Leading Companies

Scale industry players that are growing market share

Attractive Industries

Secular tailwinds with long-term demand

Experienced Management

Partnership with proven managers who make personally meaningful equity investments with us

Assetpulse Private Equity

Our private equity provides active asset management solutions to help clients meet their investment objectives

Over the past 10 years, our global investment teams have developed a wide range of product solutions to address clients’ varied and evolving needs. From core and multi-sector investing to more focused mandates.

Strategy driven leadership development

We are a creative and strategic company and we offer you fresh ideas for your team and company.

Our goals are to maximize individual potential, increase commercial effectiveness, reinforce the firm’s culture, expand our people’s professional opportunities, and help them contribute positively to their greater communities.

OUR STRATEGIC PILLARS

A set of fundamental shifts in 2020 profoundly impacted the financial services sector. The demand for sustainable solutions and green finance rose to new highs. Interest rates are expected to remain lower for longer. And the Covid-19 outbreak increased our customers’ propensity and preference to engage digitally.

The current stage of our strategic plan responds to those shifts and aligns to our new purpose, values and ambition. It has four key pillars.

Our strengths

We are a balanced and diverse business with unique capabilities. We use our strengths to generate value for our stakeholders and reach our goals.

A solid financial position

We are rated AA–/positive by Standard & Poor’s. Our solid financial position reassures our customers that we will be there when they need us to handle their claims and gives confidence to our shareholders that we are financially stable. It also gives us a well-earned positive reputation as a business and employer, and positions us to invest in future growth.

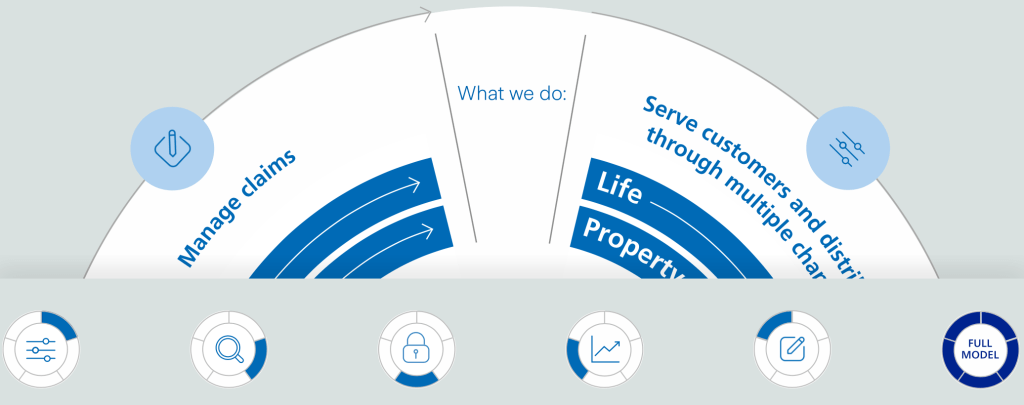

A balanced business

Our business is balanced both geographically and by products and customer segments. Our strong retail and commercial franchise and flexible operating model means we can weather economic and market volatility and take advantage of industry change.

A trusted brand, talented people

We understand the risks our customers face and can structure offerings that meet their needs. This reinforces our global brand, one of the most valuable in the insurance industry. Our strong reputation allows us to attract the best talent worldwide.

Our business model works to deliver benefits for our stakeholders

Our employees are helping our retail and commercial customers to understand and protect themselves from risk.